Description

We just posted an idea on EEFT and we think that IMXI is a very similarly attractive idea:

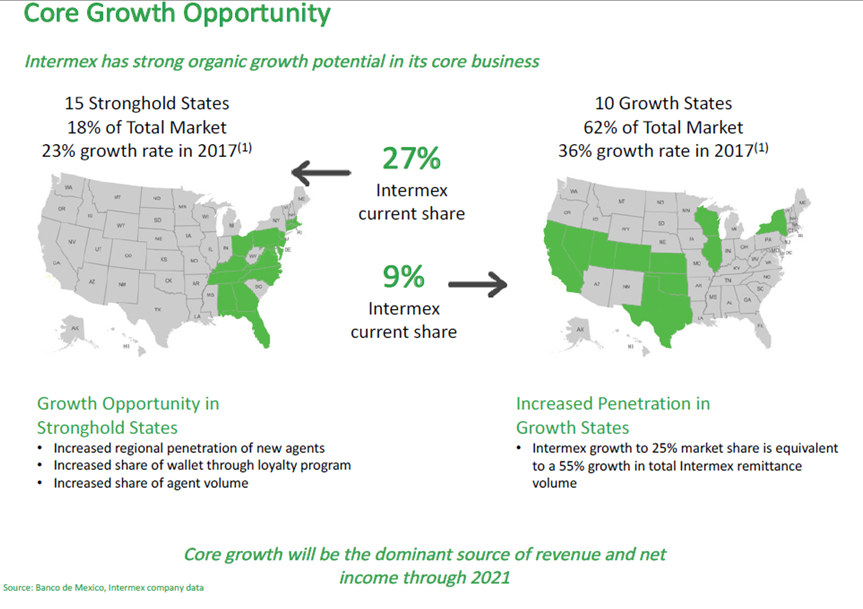

International Money Express (IMXI) is a well-run, somewhat-recurring revenue payments-esque company with a strong balance sheet and talented, incentivized management trading less than 10x our current earnings power and with 15% LT growth

-

IMXI is the leading player in the US/Mexico corridor money remittance industry

-

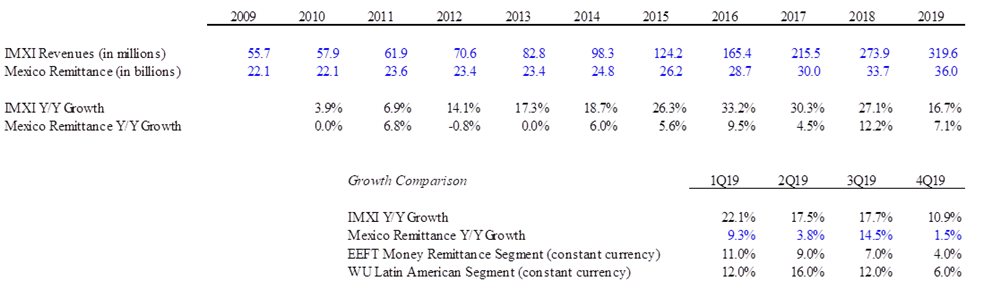

Nimble, niche operations and superior execution have allowed IMXI to grow much faster than the industry

-

CEO Bob Lisy and his team are talented and well-incentivized

-

Valuation is attractive

-

IMXI is likely worth double its current value in a year or two

-

IMXI is somewhat misunderstood, even by some analysts who cover the stock

-

While SPAC’s have deservedly bad reputations, IMXI is a rare SPAC with a healthy balance sheet, solid execution and an attractive valuation

Thesis:

Robert Lisy has served as a director of International Money Express, Inc. since 2018. Mr. Lisy served as a director of Merger Sub 2’s predecessor entities from 2009 to 2018. Mr. Lisy is the Chief Executive Officer, President, and Chairman of the Board of Directors of International Money Express, Inc. and its predecessors, which he joined in 2009. Mr. Lisy has 28 years of experience in the retail financial services and electronic payment processing industry in various positions, including four years as the Chief Marketing and Sales Officer of Vigo Remittance Corp., a money transfer and bill payments service in the United States and internationally, and over seven years at Western Union in various sales, marketing and operational positions of increasing responsibility. Mr. Lisy was a founding partner of Direct Express/Paystation America, which offered, among other things, prepaid debit cards to federal benefit recipients, where he served as Chief Operating Officer and on the board of directors. He was an integral part in the efforts to successfully sell Direct Express in 2000 to American Payment Systems. Mr. Lisy holds a bachelor’s degree from Cleveland State University.

-

Valuation is attractive

-

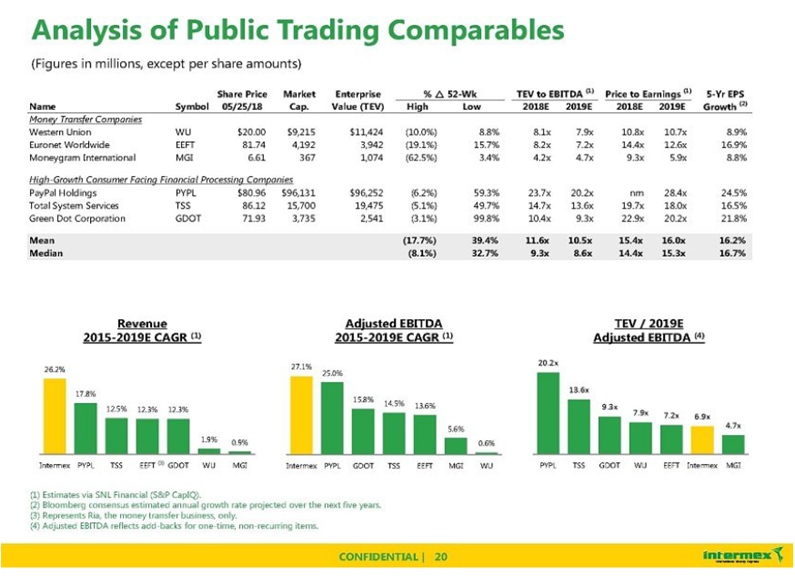

IMXI is likely worth double its current value in a year or two: We think the multiple compression for IMXI has been too severe. While the next few quarters will certainly been difficult for IMXI’s customers given many of them work in restaurants and bars and most are undocumented and therefore won’t receive unemployment benefits or stimulus, we believe that the earnings power is not impaired. We believe IMXI will earn $1.00 per share in 2020 and grow 15% from there and deserves a 15x-20x earnings multiple

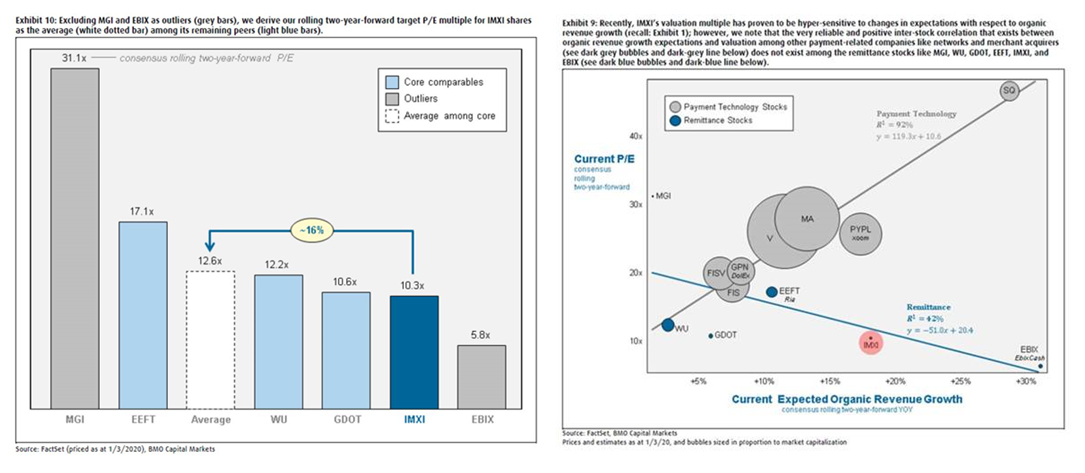

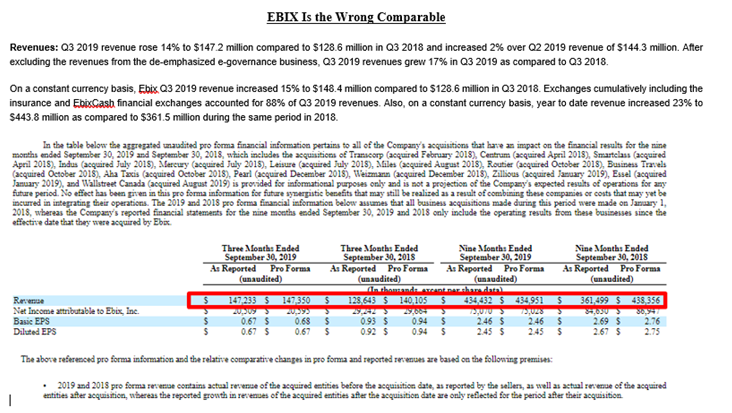

BMO - $13 price target, but uses EBIX as a comparable for money remittance to justify their low multiple and the lack of “correlation” between growth and multiples for money remittance companies. We believe this is wrong because a) EBIX has some very questionable business characteristics (long story and not relevant to this write-up, but can Google “EBIX short thesis” and lot will come up), b) EBIX is actually not growing at the 20% rate that BMO uses, but in fact shrinking organically which is masked by M&A and c) if IMXI was valued appropriately and EBIX excluded, you would see a good correlation for growth/multiple in remittance stocks, the same way you for payments

CS even acknowledges that IMXI (at a much higher price) implies negative long term growth

Among the peers outlined in the SPAC merger presentation, IMXI has actually greatly outperformed its 2019 (and by correlation, 2020 and beyond) expectations, yet has suffered the worst multiple compression (except for GDOT, where earnings are down a lot):

And this is in a world where some @SS CLOWN failed-venture-capital bullsh*t artist can bring a space travel company public via a SPAC, have it trade up 329% before reporting a single quarter of results and immediately file for another fcking SPAC, stating:

https://www.sec.gov/Archives/edgar/data/1801169/000110465920027165/tv537453-ipobs1.htm

The closing price of IPOA on February 27, 2020 was $21.97 per share. Including the warrants underlying the units, the return to investors who purchased units in IPOA’s initial public offering was 166% through February 27, 2020.

Sorry, I digress. The point is: IMXI has delivered and its shares are cheap.

The author of this post or his employer or a firm of which he is a partner may have a position (long or short) in the securities of companies discussed and such position (and the author’s views) may change at any time and the author has no obligation to update this post in such event. This is not a recommendation for any person to purchase or sell any of the securities discussed.

APPENDIX MATERIALS

I do not hold a position with the issuer such as employment, directorship, or consultancy.

I and/or others I advise hold a material investment in the issuer's securities.

Catalyst

Catalyst: 1Q / 2Q earnings demonstrates resiliency of business and financial model, increased transaction volume and FX margin from Mexican peso volatility

Risks: general economic conditions, restrictive immigration policy reduces future Hispanic population in US