| 2015 | 2016 | ||||||

| Price: | 145.40 | EPS | 0 | 0 | |||

| Shares Out. (in M): | 2,316 | P/E | 0 | 0 | |||

| Market Cap (in $M): | 43,560 | P/FCF | 0 | 0 | |||

| Net Debt (in $M): | 5,079 | EBIT | 0 | 0 | |||

| TEV (in $M): | 44,644 | TEV/EBIT | 0 | 0 | |||

Sign up for free guest access to view investment idea with a 45 days delay.

- Discount to NAV

- Compounder

- Conglomerate

- restructuring

- Capital Allocation

- Potential Dividend Increase

- Special Dividend

Description

I am recommending a long in Cheung Kong Holdings, which presents an opportunity to own a compounding conglomerate franchise at a large discount to NAV, where a transformative restructuring is likely to narrow this NAV discount over the next 12 months.

Background

Li Ka-Shing

Cheung Kong Holdings and Hutchison Whampoa are the primary investment vehicles for Li Ka-Shing, a Hong Kong business magnate and currently the richest person in Asia.

Li Ka-Shing began his career as a plastics manufacturing entrepreneur in the 1950s and has accumulated wealth through a lifetime of savvy deals across a variety of industries ranging from real estate, infrastructure, telecommunications, utilities, energy and retail. Li is often referred to as “Asia’s Warren Buffett” due to his business acumen and investment track-record. His rags-to-riches story is compelling and I’d encourage readers to learn more about his career through this YouTube series: (https://www.youtube.com/watch?v=h8hRjZViZvU)

I include this brief biography simply because one of Cheung Kong’s attractions is that it is helmed by one of Asia’s most capable capital allocators, who has created enormous wealth from these investment vehicles.

Cheung Kong / Hutchison Whampoa

Li currently serves as Chairman of both Cheung Kong Holdings and Hutchison Whampoa, both publicly listed on the Hong Kong Stock Exchange. Cheung Kong Holdings was initially formed as Li’s real estate development company and listed on the Hong Kong Stock Exchange in 1972. Cheung Kong Holdings then acquired Hutchison Whampoa, a massive conglomerate with significant interests in ports, properties and retail assets, from HSBC in 1979.

Today, Cheung Kong has a market cap of HKD ~338bn ($44bn USD) and Hutchison Whampoa has a market cap of HKD ~431bn (~$56bn). Li personally owns 43% of Cheung Kong, which in turn owns 49.97% of Hutchison Whampoa. Both are sprawling, opaque conglomerates with a variety of cross-holdings whose convoluted structures are a consequence of a lot of wide-ranging M&A over the years. The primary assets of each Company are listed below and illustrate why trying to value or understand these two companies can be a very hairy exercise:

Cheung Kong:

-

Publicly listed investments: 49.97% interest in Hutchison Whampoa, 45.3% interest in CK Life Sciences, 12% interest in TOM Group, 22% stake in Fortune REIT, 33% stake in Hui Xian REIT , 8% stake in ARA Asset Management

-

Property development assets in Hong Kong, China and other locations

-

Residential, office and retail real estate investment properties in Hong Kong and China

-

Hong Kong and China hotel assets

-

Other: utility projects, aircraft leasing

Hutchison Whampoa:

-

Telecommunications: 3 Group Europe, 88% interest in Hutch Telecom Australia (publicly listed), 12% interest in Hutch Telecom Hong Kong (publicly listed), 25% interest in TOM Group (publicly listed)

-

Container ports: 27% stake in HPH Trust (publicly listed); owns ports in China, Hong Kong, Europe and Asia

-

Retail: AS Watson, Marionnaud, 72% stake in Hutchison Harbor Ring (publicly listed)

-

Property: Property development, investment properties and hotels in Hong Kong and China

-

Energy & Infrastructure: 34% stake in Husky Energy (publicly listed), 78% stake in Cheung Kong Infrastructure (publicly listed)

NAV estimates vary, but research analysts peg a 2015E NAV of ~HK$220 for Cheung Kong and ~HK$145 for Hutchison Whampoa, suggesting both entities trade were trading at ~40% - 45% discounts to forward NAV prior to the restructuring.

Credit Suisse estimates that this 40% NAV discount sits at nearly its widest level since the end of 1994, exceeding the historical average discount of 17% over the period.

Transaction Overview

On January 9, 2015, Cheung Kong announced a transformative restructuring aimed at rectifying inefficiencies of its conglomerate structure and narrowing this excessive discount to NAV. The terms of the transactions are as follows:

-

Cheung Kong Holdings will become CKH Holdings (CKH) and re-domicile to the Cayman Islands. Each share of Cheung Kong Holdings will be cancelled and existing shareholders will receive one share of CKH, which will continue to be listed on the Hong Kong Stock Exchange

-

CKH will then acquire an additional 6.24% of Husky Energy in exchange for 84 shares of CKH

-

CKH will then acquire all non-Cheung Kong owned Hutchison Shares at an exchange ratio of 0.684 to 1

-

CKH will then spin-off all property assets of the combined group into a new entity called CK Property, which will also be domiciled in the Cayman Islands and listed on the Hong Kong Stock Exchange

-

Transaction is expected to close by June 2015

The diagram below provides a nice visualization of how the assets will be reorganized under the announced plan.

Opportunity

While Cheung Kong is already up ~16% since the announcement, an investment at current price levels still offers an attractive short-term and long-term investment opportunity.

Short-Term Opportunity

The announced restructuring is value-creative in a number of ways:

-

Eliminates the “double discount”

Cheung Kong currently trades at a steep discount to its NAV, with over 50% of estimated NAV derived from its 49.97% publicly quoted equity stake in Hutchison Whampoa. However, Hutchison Whampoa also trades at a steep discount to its own NAV. The situation results in a highly inefficient “double-discount” (one layer of discount on Hutchison Whampoa, and then another layer of discount on Cheung Kong’s stake in Hutch). The merger with Hutchison Whampoa collapses the double-discount (pro-forma NAV for the merged entity now captures Hutch’s full NAV rather than the publicly quoted market value).

-

Increases dividend capacity through the Cayman re-domicile

As a Hong Kong domiciled corporation, Cheung Kong can only pay dividends out of retained earnings. By re-domiciling to the Cayman Islands, both CKH Holdings and CK Properties will be able to pay dividends from both retained earnings and share premium, increasing structural capacity for higher dividends. Management expects to increase dividends in both FY15 and FY16.

-

Improves clarity of the business structure

First, the reorganization establishes a pure-play property business that will be easier for analysts to understand and value. Second, the reorganization eliminates confusing cross-ownership of assets. In the past, Cheung Kong and Hutchison Whampoa would jointly own stakes in the same targets, which made it difficult to disentangle ownership and anticipate whose capital structure would be used for acquisitions. Going forward, CKH Holdings and CK Property will have non-overlapping assets and independent business plans (CKH Holdings will acquire non-property assets, while CK Property will acquire property assets). Establishing ownership and assessing future capital allocation should be significantly improved.

-

Improves corporate governance

First, the transaction eliminates potential competition and conflicts of interests between Cheung Kong and Hutchison. Shareholders have always worried about how to align themselves with Li Ka-Shing and how assets might be “cherry-picked” between Cheung Kong and Hutchison. Li Ka-Shing recently joked that the current structure makes it “difficult for outsiders to work out which entity is the first wife and which is a concubine.” Merging the two entities eliminates this conflict of interest. The Li family will also dilute its ownership of Cheung Kong from 43% down to 30%, thereby providing a greater level of control to non-Li family shareholders. Lastly, the deal signals a willingness by Management to pursue innovative and dramatic initiatives that will support shareholder value, which provides a favorable signal to markets.

-

Operational improvements

Furthermore, the simplified structure could unlock operational improvements and facilitate improved capital structures that could drive additional value-accretive M&A.

Price Target

The reorganization should be accretive to NAV, and I estimate a pro-forma consolidated 2015E NAV / share of ~HK$227 for Cheung Kong shareholders, which I derive as follows (excuse my back-of-the-envelope math. Also note that this HK$227 NAV / share target calculates a consolidated value that will then be divided between CKH Holdings and CK Property):

The combination of all the benefits listed above will serve to narrow the persistently large discount to NAV. At a more appropriate 20% conglomerate discount on pro-forma NAV / share, which approximates the average historical levels since 1994, I believe Cheung Kong can rise to HK$182 per share, representing potential upside of ~25% from current levels.

I note that through the mid-1990s and mid-2000s, Cheung Kong and Hutchison periodically traded at premiums to their NAV. I’m not willing to underwrite a NAV premium at this time, but I believe that the usual NAV discount is not necessarily a permanent feature for many of these holding companies. Investor psychology is malleable, and with the restructuring dynamics now in place, the NAV discount is more likely to compress rather than expand, providing an attractive risk-reward.

On a relative basis, Icahn Enterprises currently trades at a 27% premium to 3Q14 stated NAV, Berkshire Hathaway trades at 1.5x BV and General Electric trades at 1.8x BV. I view these as favorable support levels for Cheung Kong, which currently trades at a 35% discount to pro-forma NAV and ~0.8x trailing book value.

Long-Term Opportunity

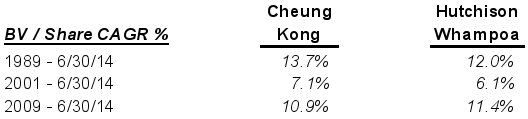

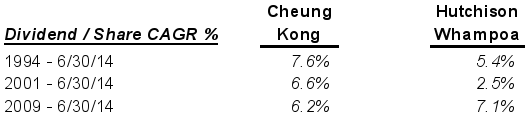

Cheung Kong and Hutchison Whampoa have compounded book value per share at attractive rates over long periods of time:

Dividends have also grown at attractive rates over this same period.

I believe the drivers of this growth have the potential to persist for generations.

-

Cheung Kong and Hutchison own a global portfolio of stable, long-lived, high barrier-to-entry assets (key assets in telecommunications, infrastructure, utilities, income-generating real estate, etc.), which provides a tremendous platform for strategic M&A (“platform value”)

-

Like Berkshire, the Company leverages its reputation as a sophisticated strategic partner to access tremendous inbound deal flow from across the world. Cheung Kong and Li Ka-Shing have a deep network of relationships in Asia that are highly valued by Western partners, and have parlayed accumulated “guanxi” (Chinese phrase for connections) into attractive business opportunities, an important component of doing business in China (http://www.businessweek.com/stories/2007-11-18/you-say-guanxi-i-say-schmoozing)

-

Management has a track record of being opportunistic and value-oriented. In recent years, the Company has aggressively divested assets in China and Hong Kong and aggressively pursued acquisitions in Europe (O2 telecommunications in the UK, Eversholt Rail in the UK, Dirx Drugstores in the Netherlands, Northumbrian Water Group in the UK, etc.), rebalancing the portfolio towards more attractive relative opportunities.

Trading at ~0.8x net book value (book value likely understates intrinsic value) and ~10x ’15 P/E, while offering a 2.4% dividend yield, and backed by a capable owner-operator with a strong track record of value creation, Cheung Kong represents an attractive long-term investment proposition with relatively low risk of downside.

Note: You can also play this investment through Hutchison Whampoa. The relative upside is essentially the same and I estimate maybe marginally better on the Cheung Kong side, at the date of this write-up.

Risks

-

China and Hong Kong slowdown

-

Deal completion risk, timing risk

-

Risks around the estimation of future NAV, which is an inherently imprecise exercise

I and/or others I advise do not hold a material investment in the issuer's securities.

Catalyst

- Completion of merger between Cheung Kong and Hutchison eliminates double discount, improves governance, improves business structure clarity

- Dividend raise / potential for a special dividend

- Accretive M&A

| show sort by |