| 2020 | 2021 | ||||||

| Price: | 0.74 | EPS | 0 | 0 | |||

| Shares Out. (in M): | 157 | P/E | 0 | 0 | |||

| Market Cap (in $M): | 115 | P/FCF | 0 | 0 | |||

| Net Debt (in $M): | -7 | EBIT | 0 | 0 | |||

| TEV (in $M): | 108 | TEV/EBIT | 0 | 0 | |||

Sign up for free guest access to view investment idea with a 45 days delay.

Description

Summary: Bragg Gaming (TSEV: BRAG) is a B2B provider of software and services to online casinos, mostly in Europe. Despite growing rapidly and exhibiting strong operating leverage as it scales, it trades at a huge discount to US (and European) listed comps, because it has been listed on a terrible backwater of an exchange (the TSEV) and until very recently had a huge earnout overhang unresolved sitting in the cap structure. This latter issue has been removed after a renegotiaiton of the earnout and a recent equity offering; whilst with regard the former, the company has articulated a plan to uplist to the TSE main board and then the Nasdaq, probably in 1H next year. For now you can buy BRAG at ~1.3x FY21E revs and ~6-7x EV/EBITDA - yes it has actual earnings - despite growing topline at 50-60% the last two years, and direct comps like GAN trading at 5-6x turns higher on revenue multiples. I expect the gap to close in the coming quarters, as and when the bloom comes off the GAN rose and BRAG relists/dual lists in the US, and think BRAG standalone has 2x+ upside from current even without a full re-rating to US peer multiples. Given some of the key players (ex-SBTech CEO is now Chairman) and cap structure (owner-operator will own ~33% of pro-forma co), and the high M&A in online gaming at present, I also think a take-out in the near-term is a strong possibility.

Background: This story is quite similar in business and analog to that of GAN from a year or so ago (please review Fiverocks' incredible write-up and call on GAN to familiarize yourself with the story/industry). Just like GAN did once, BRAG suffers from a comically low valuation (~7x 21E EV/EBITDA, and ~1.2x EV/revenue) because it is listed on a similar terrible exchange (the Venture exchange, in Toronto) where the stock is illiquid, uncovered by the street, and basically unknown. Furthermore, the company also has its fair share of ‘hair’ (a reverse merger history; executive turnover; an earnout overhang in the capital structure; and geographic concentration issues). And yet, just like GAN, it is experiencing an explosion of revenue growth (>100% in 2Q, and likely 50%+ this year); it is demonstrating impressive margin leverage and increasing client diversification; and – crucially – it has just articulated a path to relist on the NASDAQ (but the market is yet to notice).

We will discuss in detail the business, its quality issues, and the various risks (and mitigants) to the story. But with the relisting catalyst clarified and the relative (and absolute) valuation absurdly low, I cannot help but conclude there is the opportunity here to earn a multi-bagger return. Consider the GAN example: on the AIM, before relisting was announced, it traded up to as high as 2-3x revenue; after announcing the relisting, the price rerated to 3.5x revenue, and the original US IPO price ($8.5) was set at ~4x CYE revenue. Today, of course, the business trades at >10x CY revenues (and ~9x FY21E revenues):

We can and will debate, of course, the relative strengths and weaknesses of BRAG vs GAN. But the simple fact remains that there is not one single front-end operator or pureplay gaming software/content provider listed in the US that trades at <6x 21E revenues. And with BRAG at just over 1 FY21Ex revenues, the stage is set for a dramatic revaluation as and when the company relists. I expect the stock to at least double and probably triple into and throughout a relisting event (if it can be consummated) in the next 6 months.

What is BRAG?

BRAG today is essentially a holding company for Oryx Gaming, a B2B provider of content and software for the iGaming industry. Oryx was merged into the BRAG entity back in late 2018; prior to that BRAG was known as Breaking Data (BKD), and was just another microcap technology company masquerading as a business. With the recent disposal of all the remaining legacy non-Oryx assets (a media business, GivemeSport, for a token consideration), BRAG today is just the Oryx Gaming entity housed in a Canadian listed shell.

Oryx itself was founded by a Slovenian entrepreneur, Matevz Mazij, in 2012, and originally focused on developing gaming content (ie, games) to provide on a licensed basis to online casino operators, primarily in Germany (Matevz remains the head of Oryx, a major shareholder in BRAG, and the driving force behind the company’s growth – more on this later). Over time the business has grown and evolved away from native content, and more towards becoming both an aggregator of third-party (3P) gaming content, as well as a ‘one-stop shop’ turnkey platform for online operators to manage and run their online casino operations.

Today, Oryx has three main product offerings:

- Oryx Games: this encompasses both original and 3P content, and the vast majority of this is 3P content. Oryx aggregates 3P titles from a variety of the industry’s leading content creators; packages them in a bundle; and offers them to casino clients via its remote game server (RGS). Oryx collects both a one-off integration fee (per client) as well as a very, very slim ongoing service fee - the margins for this segment are necessarily extremely thin (mid-single digit gross margins), as Oryx is simply collecting good content and passing it along;

- Software licensing platform: the reason Oryx takes the trouble to curate and package high-quality content is to win the platform business that often goes along with it. Oryx offers a one-stop solution to manage all the needs of the casino operator – from games, to sports betting, to lottery; to player account management (PAM); to risk management; marketing/campaigns/bonuses; and of course customer analytics. In essence, Oryx is offering a complete ‘plug and play’ offering for new and smaller operators, often those looking to enter a new market for the first time or go to market quickly and seamlessly. As per other software providers, Oryx is paid a take rate based on Gross Gaming Revenue ('GGR') that varies with the extent of each service contract. Just like for GAN, as each particular client scales, incremental margins for Oryx should be very high as the incremental revenue drops straight through to the software provider with little additional cost (and we are beginning to observe this in the PnL);

- Turnkey solutions/management: in addition to the software platform, Oryx further offers the client an outsourced management solution, where Oryx will manage the online casino (or aspects of the casino operation), remotely, on the client’s behalf (using Oryx’ native analytics and management). Margins here are lumpy and project-based, but generally much higher than the Games business (but lower than the Software licensing).

Content aggregating is not difficult, clearly, and the core platform offering doesn’t sound too sophisticated either, so I was initially skeptical that BRAG had anything differentiated to offer the market. But the simple fact is BRAG has grown like a weed, and acquired new customers at a furious pace during its short history as a business:

- It acquired its first client, OnlineCasino.de, in 2013;

- By 2015, it had onboarded 20 clients;

- In 2016, it developed a free play casino solution for Rush Street Interactive in NJ (in advance of US market regulation;

- In 2017, it added further well-known names like Mr Green, JackpotJoy, and BetCris to its roster, and reached 60 clients by year end;

- In 2018, it received regulatory approval in the UK, Croatia, Spain, Czech, and Colombia, and added marquee names like GVC and Unibet to its client roster;

- By the end of 2019 it had 80 total clients and had entered the US market in partnership with Kambi, to develop an iGaming platform and PAM system for Seneca Gaming in New York;

- More recently, Oryx has been a clear beneficiary of the offline-to-online shift evident in gambling post-COVID, with 1Q and 2Q revenue growth coming in at 45% and 105%, respectively, and the company guiding to 50% revenue growth for the 2020 fiscal year.

In other words, despite the apparent lack of ‘edge’ to the business, they appear to be doing something right, as they have consistently added new clients at a strong rate – indeed far faster and more frequently than some of their more well-known competitors (GAN for example only added a handful of clients last year and will be lucky to onboard 10 clients this year). I believe there are two main differentiators that set Oryx apart. The first may simply be that Oryx is able (or just more willing) to offer a cheaper, instant software solution to new and emerging operators, in a variety of geographies – some regulated, others not – whereas some of the other names have focused on either larger clients (Playtech) or specific geographies (GAN).

A second differentiator appears to be Oryx' willingness to experiment with new tools to 'gameify' the player management experience. For example, in July this year they launched Leaderboards and Tournaments: tools allowing the operator to turn normal slots gaming into a social competition (like Peloton, but for gambling), creating further player engagement and leading to a spike in activity for the testing operators; this tool was then rolled out across the product suite for all clients. While it is difficult to assess how unique their software offering truly is, the uptake by a wide variety of increasingly respectable clients like Unibet, GVC, Jackpotjoy, 888, etc, is further confirmatory evidence that suggests they are a reputable operator with a solid turnkey offering.

By mid-2018, Oryx was run-rating ~$20mm annualized revenues but was still capital-constrained (as a small Slovenian company with 50 employees) so Matevz re-domiciled the business in Nevada and came public by way of a reverse merger with the BKD shell. The acquisition closed in late 2018; Matevz stayed on to run the Oryx business; and most of the original purchase consideration was structured as an earnout, whereby only a fraction (~20%) of the initial price was paid in cash at closing, and the majority of the transaction would be paid, in stock and/or cash, based on future earnings of the business as follows:

Whilst this was a great deal structure to ensure Matevz remained aligned with shareholders, it also had the effect of complicating the investment story and indeed creating a significant overhang on the stock. The issue was as the business grew far more rapidly than expected (in 2019-1H 2020), this earnout got remeasured at fair value (as a liability); moreover, since a large chunk of it came due in mid-2020 (the first earnout tranche), this appeared as a sizable current liability that created the spectre of a liquidity issue if it couldn’t be financed/renegotiated. Thus whenever anyone looked in the accounts over the last 3 or four quarters, they saw a balance sheet with a huge negative working capital position...

...and had to read disclosure warnings that included a rather scary 'Going Concern' section like this:

As a small-cap with zero street coverage and limited access to liquidity, this earnout represented a real problem and critical overhang on both the stock and the business - one that thankfully has just been resolved, and in the best possible way for shareholders.

Renegotiating the earnout; SBTech exec comes on board; heading for the NASDAQ

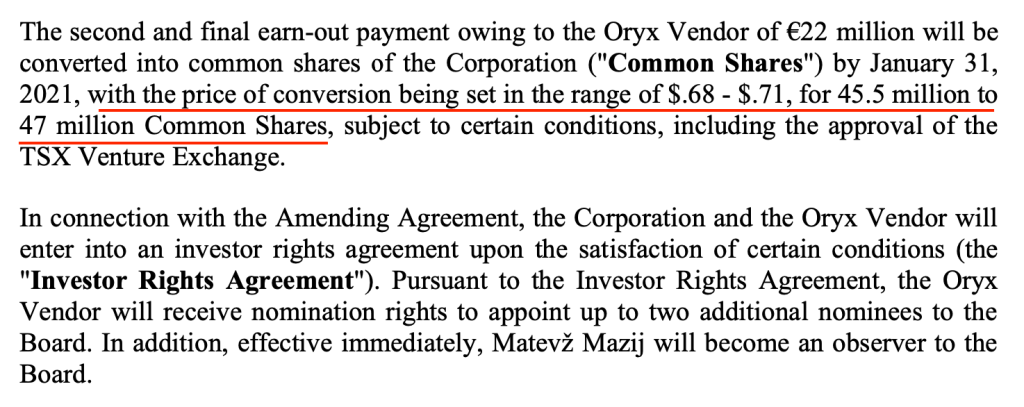

The first clear positive signal suggesting imminent revaluation in the stock is the form of how Matevz’ earnout has been recut. Since the original payment was coming due in mid-year, Matevz would have been well within his rights to play ‘hardball’ and demand being granted a huge portion of the company’s stock at a discounted price (to take his earnout payment in equity). As it is, however, he was happy to strike the earnout at a significantly above market stock price, per the below agreement:

(note that the earnout conversion price was subsequently reset to 73c, ie, a little higher than the above). BRAG’s stock was around 50c at the time, meaning the executive who built the company and presumably knows more about the trajectory of the business than anyone else was happy to use a price 40% higher than current – a level perhaps double that he could have extracted given his negotiating leverage. Why would Matevz be so generous? He will end up owning ~35% of the new pro-forma equity, but conceivably he could have owned a whole lot more. Why was he so relaxed about the strike price of the stock?

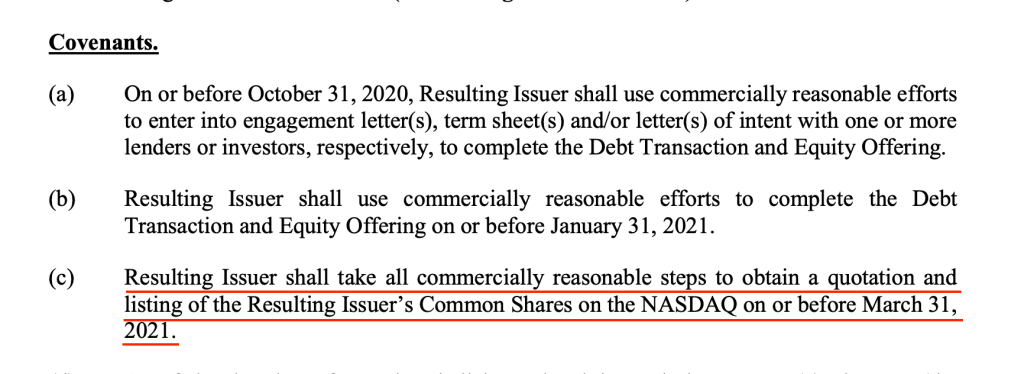

An amended debt filing from just a few days later gives us some further clues. In delineating the terms of the amended earnout, there is a specific condition mentioned regarding a NASDAQ relisting being accomplished by the end of March next year:

In other words, Matevz is happy to push out his payments to January next year, and take a well above-market mark on his stock conversion - provided that said stock will be NASDAQ traded shortly thereafter! This wasn’t the first time a potential relisting had been mentioned by the company: going back to the 2Q call, Adam Arniv (a board member at the time, and a major shareholder; now interim CEO) had suggested the company would pursue a NASDAQ listing in the future, though no timeline was given. But with a specific date now written into the SEDAR filings, there seems a strong likelihood that BRAG is pursuing a relisting in the near-term (otherwise you wouldn’t put it down on paper in an official filing). It would not surprise me in the slightest to see this mentioned, formally, in the upcoming 3Q earnings release, and given the March, 2021 deadline in the amended deal docs, you would think an S-1 would be filed quite promptly (perhaps by year end).

No doubt this is also why SBTEch’s former CEO, Richard Carter, was brought on board recently as well. It puzzled me at the time why someone who got paid out (I think in excess of $100mm) when SBTech merged with DraftKings would bother with a Canadian small-cap – though the press release announcing his appointment did offer some cryptic clues:

'Consideration of all accretive M&A opportunities' when your own equity trades at 1.2x revenues doesn't seem to imply buying other companies. Rather, I believe Carter is suggesting, obliquely, other value-enhancing M&A may be on the table (either a merger or being acquired by a US player). But in any case a relisting locally in the US is a prerequisite to achieving any of these aims, and for that Carter brings credibility and recent experience.

In any case we no longer need to read the tea-leaves: Matevz agreed a higher price because he – presumably – can see the end-game in sight (a relisting in the US), and the valuation gap is so gargantuan between his company and any potential US comp that he cannot help but be deeply in-the-money if or when that happens. No doubt this is what Mr Carter saw as well:

BRAG vs GAN: how different are they, really?

I keep coming back to GAN as the right comp for BRAG because on closer examination I really feel they are far more similar than different – both as businesses, but also as investment narratives. Of course, GAN has focused almost entirely on the US, whereas BRAG supports a variety of European, Latin American, and (one or two) US operators, so the geographic focus is certainly disparate. But in many other ways the stories seem a carbon copy:

- Both provide B2B gaming software (‘picks and shovels’) to front-end operators;

- Both aggregate third-party content as well as their own native content as part of their revenue stream;

- Both have a mixed revenue model, whereby some revenues are extremely low margin (the content aggregation and delivery side) versus higher-value, recurring platform revenue;

- Both have some one-off, project-type revenue as part of their mix;

- Both are growing rapidly (though BRAG is growing faster);

- Both are/were listed on terrible backwaters of the capital markets and traded/trade at a huge discount to direct comps in the US;

- Both exhibited a revolving door at the CFO position in recent years;

- Both have had historic customer impairment issues (GAN with Winstar; BRAG to be discussed).

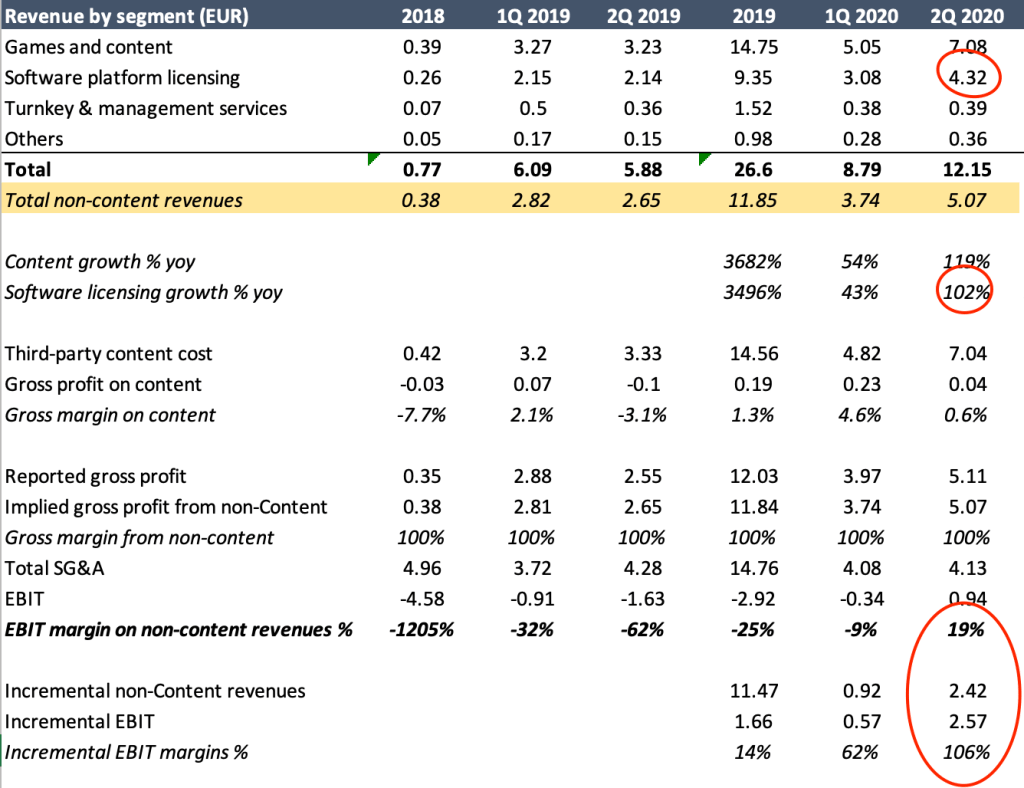

The scale of the respective businesses is similar, too. In its most recent quarter, BRAG posted 12.2mm EUR revenues, but if you ignore the low/no-margin content aggregator revenues, they did 5.1mm EUR of other revenues, of which 4.3mm is high-margin recurring software platform revenues (and which grew 105% YoY). Annualizing just the platform revenue implies 17mm EUR, or ~$20.5mm in USD:

Now compare to GAN. In their 2Q, they reported $6.4mm of (what they define as) SaaS revenue, which is $26mm annualized (and growing at similar ~100% rates)…but GAN trades at 15x last quarter annualized (LQA) software revenues, whilst BRAG trades at just 3.2x. The overall revenue multiples looking out one-year – 9x for GAN, 1.2x for BRAG – are similarly in different leagues.

Moreover, the underlying profitability (and perhaps quality) of each of these businesses is probably closer than we think, as well. If we remove the pass-through content aggregator revenues (and costs), the implied EBIT margins on the non-content revenues at BRAG are quickly scaling to levels analogous to those at GAN. That is, EBIT margins on the non-content piece of the business are already closing in on 20% – reflecting a similar business earnings power to GAN, as we would expect for similar offerings – masked simply by the higher revenues coming from content aggregation than exist in GAN’s case. Here is the recent improvement in earnings at BRAG, driven by the explosion in high-margin platform revenue in the last couple of quarters - of course I would expect to see more scaling in the upcoming 3Q report, as well:

Meanwhile GAN is currently earning a (heavily-adjusted) 17% EBITDA margin (so call it teens EBIT margins, essentially equivalent to BRAG) on only a slightly larger recurring revenue pool.

GAN bulls would point to the perceived ‘moat’ at GAN with regard to their loyalty program patent (whereby they and they alone have the right to link a casino client’s loyalty program to their online gaming wallet) – but this hasn’t stopped key client FanDuel walking away from GAN’s core technology at the earliest opportunity. Perhaps the simple reality of many of these go-to-market software platforms in the industry is that they will be supplanted, in time, as the clients become bigger and develop more of their own resources (this is certainly how the market has evolved in the UK). Thus, how much of a moat does GAN really have in reality? And indeed if that is the case, over time, wouldn't you rather ride with the company that has as diverse a client base as possible, rather than any customer concentration at all. In this regard BRAG bests GAN too.

In sum, I am in no way arguing BRAG is the superior business, and no doubt there will likely always be a bit of a discount applied to BRAG given the lack of much US exposure (at least for now), as well as for some of the other idiosyncracies attached to the BRAG story. But in the context of businesses much more alike than different, the disparity in price here is simply untenable and remains most entirely a function of the different marketplaces they trade in. I expect this to correct, rapidly, once the marketplaces are one and the same.

The ‘hair’ on the story

Every silver lining has a cloud, so they say, and BRAG is no different. There are three main risks, as I see them: Germany concentration; client creditworthiness; and executive turnover. Let’s dedicate some time to consider each of these points.

Germany: as mentioned earlier, German-facing operators were the original customers Matevz' platform in the early days, and while the German concentration has been decreasing as the business has scaled, they exposure is still substantial at 28% of revenues (I expect this to be ~25% post 3Q). For most of the past four years, the German market has operated in a grey area, where there is no unified national regulation of online gambling or sports betting, but front-end operators have been able to provide such services to Germans through Schleswig-Holstein licences (one particular state that allowed such access). This is changing, however, and from July next year, the market will become fully regulated at the national level, with a set of new restrictions on types of games and stake limits, that are designed to prevent problem gambling.

For our purposes, the overall takeaway is mixed: on the one hand, the new rules won't go into effect for a further 9 months, so there is likely to be no impact on 2020 results. But from next year, it is reasonably likely the German market (as measured in GGR) contracts. When Sweden went through a similar transition in 2019, the overall market - as measured by both regulated and unregulated gaming - shrunk a little, as a number of unregulated operators either left the market or transitioned to the regulated environment but couldn't generate as much GGR due to the restrictions. In this case, BRAG's exposure is entirely casino (no sports, where the restrictions seem a bit stricter); and are largely on the slot side (where, unlike blackjack/roulette, gaming will be allowed during the transition period, even if the stake limits are much lower than they were). It is difficult to assess exactly what the effect will be in toto, but I would expect a contraction at least in the second half of the year next year, perhaps a substantial one, during the early innings of the regulated market. In the end, this may turn into an opportunity for BRAG as previously-unlicensed operators turn to them for an approved, regulatory platform and solution (and this is certainly what the company is suggesting in its communications for now). Nonetheless, I expect the comps to get somewhat difficult in Germany in the second half of next year, and that to be reflected in BRAG's 2021 guidance (when they give it early next year). Perhaps that is why they are aiming to relist on the Nasdaq as soon as possible.

Client creditworthiness: perhaps the most cringeworthy part of taking a close look at BRAG is the extent to which they suffer credit losses on their accounts receivable. As part of the business model, BRAG services a number of 'questionable' clients who, it appears, aren't well capitalized and perhaps operate in spurious jurisdictions. As a result, they have been dogged by high impairments of receivables historically, where most all receivables over 90 days past due are totally written off. In the most recent fiscal (2019), the impairment ratio on past due receivables fell, a little, but was still quite substantial; and this pattern continued during 1H this year. There is no escaping this, really, other than to note that at least as the business scales, it does appear to be improving in quality - since the rate at which receivables are being written off is as low as it has been. The new write-offs in 1H this year, for example (0.45mm EUR) represent 8% of gross receivables, and just 2% of 1H revenue. So it does appear that as the business grows it is becoming less dependent on bad-credit counterparties, but this of course bears close monitoring to make sure the trend continues in the right direction.

Executive turnover: the final yellow flag has been the curious amount of CFO turnover that has occurred since Oryx was acquired. BRAG has been through 2 CFOs in the last 1.5 years, and recently the CEO since the merger - Dominic Mansour - took a leave for 'personal reasons', to be replaced by Adam Arviv (a major shareholder), whose mandate it appears is simply to shepherd a relisting of the business onto the NASDAQ (I don't think Mansour will return to the company). There is no clear explanation for the two CFO departures: both were labeled 'for personal reasons' and there was no further detail given. The only solace I can find in all this is that GAN also had a revolving door at the CFO position (losing 2 CFOs in the 18 months leading up to relisting) - but it didn't stop the highly-successful transition (nor business momentum). Indeed, for small-cap companies you often see more executive turnover than at larger, better-capitalized ones, and here, as at GAN, it hasn't appeared to affect the business at all - probably because the key man in all this is Matevz, and he remains a core part of the leadership team and fully aligned via his new pro-forma equity ownership of ~35% of the company. At the same time, the new CFO - Ronen Kanoor - appears to have been specifically selected for his public market expertise, as he oversaw the AIM listing of Stride Gaming, as well as its eventual sale to Rank - so perhaps the explanation is as innocent as gathering as many executives (Carter and Kanoor, et al), with public market experience as possible.

The sum total of these yellow flags necessitates an implied discount versus some of the other US comps, of course (even though GAN shared many of these same issues). But the beauty of this situation is that the valuation is already so discounted, that you don't need to get a full GAN multiple, let along a DKNG-type multiple, to see a huge excess return. In fact I expect a re-rate simply to something more pedestrian, relatively (3-4x 21E revenues, perhaps a 20x EV/EBITDA multiple on real earnings that many of its US-listed comps won't generate), and that alone will catalyze a near triple.

Putting it all together

The pro-forma capitalization is ~157mm shares and ~8-10mm in net cash (pro-forma for the recent equity offering and converting Matevz' earnout to shares). In EUR, this implies a fully-diluted Enterprise Value of 65mm versus a business that is guided to do 5.5mm of EBITDA this year and close enough to 40mm EUR in revenues. Next year I think the business will grow at 25%, with negative growth in Germany offset by ongoing 40%+ growth in the non-German parts of the business (non-Germany revenues grew +132% YoY in 1H this year so I don't think this is very aggressive). I assume incremental margins basically in line with what was experienced in 2Q - even though FY20E guidance implies much higher marginal profitability this year, and thus likely more as the business scales further next year.

This all puts the business on barely 10x EV/EBITDA this year and 6.7x next year; and basically 1.2x EV/revenues on FY1 numbers. As has been frequently mentioned, in the context of other online gaming software providers and front-end betting operators listed in the US, these kinds of multiples are almost comically low - even allowing for some of the idiosyncratic risks facing the BRAG business.

Thus, this trade - and perhaps it is more of a trade than a true investment - is all about the relisting catalyst. If or when the company can accomplish this, I expect the stock to rapidly re-rate to at least the same stratosphere as those names, if not the same zip code - which I ballpark as at least 3.5x revenues/ 20x EV/EBITDA on FY21E numbers. To me this suggests a 2 CAD stock, good for ~170% upside from the current quote, and likely more once the US retail speculators get a hold of it (as happened with GAN after relisting).

Event/M&A upside risk

As has been discussed on the GAN thread, GAN recently purchased Coolbet, a B2C operator with not-dissimilar geographic exposure and a similar revenue growth trajectory (but no profits), for 7x LTM revenues and 3.5x forward revenues. At the very least this implies high-growth igaming assets are in vogue (even if I think the acquisition was a poor one for GAN). At similar multiples BRAG would be a $2 stock and with management now solely focused on value maximization (the board owns ~45% of the pro-forma shares), I believe if a relisting won't improve the multiple to where it should be, the company will consider strategic alternatives. It is perhaps no accident that many gaming names listed in Canada have ended up being taken over (Stars, NYX, etc), and BRAG may well follow in this path, especially now that the SBTech former CEO has joined the ship with no role other than to apparently shepherd this asset to a place where it can be valued properly.

I and/or others I advise hold a material investment in the issuer's securities.

Catalyst

ongoing revenue growth + margin expansion

relisting on TSX main board

relisting on Nasdaq

potential takeout by competitor

| 6 show sort by |